Many questions crop up about consignment and price-after-sale (PAS) in the produce industry. Given the potential for confusion, we’ve outlined their distinct features and significance to ensure a clear understanding and prevent misinterpretation.

In a dispute, the requirements and burdens of proof for both transaction types are different, which means that the parties’ responsibilities and legal obligations may vary depending on the type of transaction.

Below, we explain the two types of transactions in further detail. But first, here are some of their similarities:

- They have no fixed price or return;

- Both tend to be used when trust in the commercial relationship has been established or when the produce fails to meet contract terms upon arrival.

- Lastly, certain default expenses may be deducted from the gross proceeds realized from the sale of the produce.

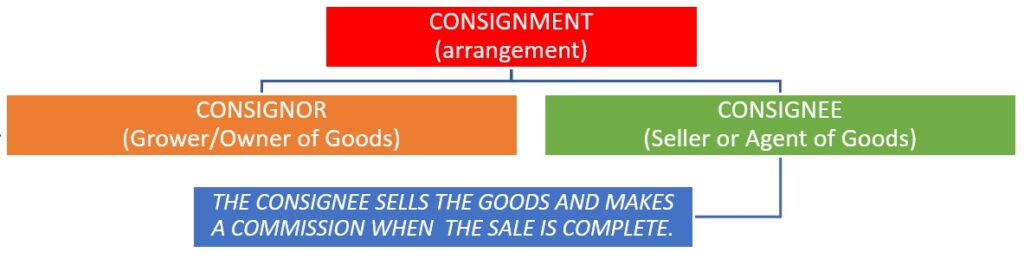

Let’s start by defining a consignment. It is an arrangement in which goods are left in the possession of another party to sell.

The consignor is the supplier and owner of the goods left on consignment. The consignee is the seller or agent who acts on behalf of the consignor to market the goods. The consignor continues to own the goods until the consignee sells them and the consignor receives money from the sale. The consignor and the consignee must discuss what expenses the consignor can subtract from the sales of the goods. Once the consignee receives the goods, they sell it at the best price possible on the consignor’s behalf and earn a commission from the sales.

The consignee is free to sell the product at a price that maximizes its value and is encouraged to strive for the best price possible. It is also advisable to prioritize the product and move it quickly. In a consignment transaction, Market News or Infohort may be used as a point of reference for sales or a minimum guaranteed price in their written agreement.

Once the goods are sold, the consignee is responsible for providing an itemized account of sales. This liquidation report must outline the price, amount, and date of each product sold, along with any agreed-upon expenses such as freight, warehousing fees, inspection fees, and commission. The consignee’s commission typically falls within the 8% to 15% range, sometimes more. However, this would have been established in a written agreement to prevent any misunderstandings.

Because of the trust factor between the consignor and the consignee, an inspection of the goods upon arrival is not necessary unless otherwise agreed. This trust is built on the understanding that the consignee will accurately report the sales and deduct the agreed-upon expenses, and the consignor receives the rightful payment for their products.

Consignment transactions come with certain restrictions for the consignee, unless otherwise agreed. The consignee cannot re-consign or sell the product on open price terms, and because of the conflict of interest, the consignee cannot sell the product to a sister company or a company with similar ownership.

PRICE-AFTER-SALE (PAS):

PAS is a type of sale where no price has been agreed upon, but instead, anticipate agreeing on a price after the buyer sells the product. If the seller disagrees with the price offered by the buyer, the buyer must be able to support the reason for their offer. If negotiations on a price are not successful, even though it is not required, an account of sales is the most common method to show how the product was handled. This usually involves showing a prompt and proper sale less expenses to demonstrate how the buyer arrived at the return offered. If the return does not at least yield market prices, it becomes the buyer’s responsibility to show why they could not sell the product at market prices.

Submitting an account of sales must contain the same elements as an itemized account of sales in a consignment transaction, except for a commission, which is only permissible if agreed upon. If there is no damage to the product, the expectation is that the product will sell close to or at prevailing market prices.

If, during a PAS transaction, the buyer receives damaged goods, the buyer must request a federal inspection to prove that the load was received in deteriorated condition providing support for sales below market prices. In addition, the results of the federal inspection report must show that the goods failed to meet contract terms or DRC Good Arrival Guidelines.

When Is a Federal Inspection Necessary?

A federal inspection showing the product has failed to meet contract terms or DRC Good Arrival Guidelines is necessary for consignment and price-after-sale transactions to show why the sales of the goods were below market prices. However, a federal inspection is mandatory when 5% or more of the produce received has no commercial value and requires dumping or donating. It’s important to note that a dump certificate is not the same as a condition inspection report showing the product’s lack of commercial value.

CORRECTING INTERCHANGED TERMS ON AN INVOICE:

Please remember that consignment and PAS are different trade terms and should not be used interchangeably. If you receive an invoice that swaps the two terms, contact the sender to have it corrected. In consignment transactions, ensure that the terms were discussed, understood, and agreed upon, preferably in writing. DRC’s Good Arrival Guidelines indicate that in the absence of an agreement on the terms of the transaction, the default would be FOB No Grade Good Arrival Guidelines. Lastly, if no price is agreed upon, the price defaults to market price.

If you have any questions about the article and would like to learn more, our team at the DRC is here to assist you. We value your inquiries and are eager to provide support. Click here to proceed.